Latest News

It's not too late to buy these stocks at a great price before they take off.

Via The Motley Fool · February 4, 2026

The first capital markets’ month of 2026 is now complete but the proposed appointment of the new Fed Chair changed a lot of the monthly returns significantly in just one day of trading.

Via Talk Markets · February 4, 2026

Investing in Dominion Energy could be a good way to profit from the growth of the artificial intelligence sector.

Via The Motley Fool · February 4, 2026

Steel Dynamics Inc (NASDAQ:STLD) Offers a Durable Dividend Backed by Strong Fundamentalschartmill.com

Via Chartmill · February 4, 2026

Disney is the king of the box office, but the benefits run deeper than ticket sales.

Via The Motley Fool · February 4, 2026

COLLEGIUM PHARMACEUTICAL INC (NASDAQ:COLL) Presents a Classic Value Case with High Earnings and Low Valuationchartmill.com

Via Chartmill · February 4, 2026

Manulife Financial Corp (NYSE:MFC) Shows High Technical and Setup Ratings for Potential Breakoutchartmill.com

Via Chartmill · February 4, 2026

Construction Partners Inc. (NASDAQ:ROAD) Combines High-Growth Momentum with Bullish Technical Setupchartmill.com

Via Chartmill · February 4, 2026

Changing your credit card due date won't hurt your credit. Here's how it affects billing cycles, autopay, and late-fee risk.

Via The Motley Fool · February 4, 2026

Druckenmiller has renewed his AI bet.

Via The Motley Fool · February 4, 2026

In a chat with Reliance Industries CEO Mukesh Ambani, organized by Moneycontrol, Fink stated that it is necessary to rapidly expand AI opportunities.

Via Stocktwits · February 4, 2026

Monthly trading volumes have gone from millions to billions in short order. Exploring what that could mean for investors.

Via The Motley Fool · February 4, 2026

BORGWARNER INC (NYSE:BWA) Shows Strong Technicals and High-Quality Setup for Potential Breakoutchartmill.com

Via Chartmill · February 4, 2026

Insulet Corp (NASDAQ:PODD) Matches Key Growth Rules in Navellier's "Little Book" Strategychartmill.com

Via Chartmill · February 4, 2026

ICON PLC (NASDAQ:ICLR) Presents a Compelling Value Investment Casechartmill.com

Via Chartmill · February 4, 2026

Should investors listen to this famous short-seller?

Via The Motley Fool · February 4, 2026

JPMorgan Chase & Co. said sentiment toward software companies has grown notably harsher, with valuations now punished before firms can make their case.

Via Stocktwits · February 4, 2026

IonQ is the most popular quantum computing stock. It's not necessarily the best investment in 2026.

Via The Motley Fool · February 4, 2026

Software stocks across Asia, from India to Japan, took a hit as concerns mounted over how advancements in artificial intelligence could disrupt traditional business models, echoing the declines seen in their U.S. counterparts.

Via Talk Markets · February 4, 2026

Cavco Industries Inc. (NASDAQ:CVCO) Passes the "Caviar Cruise" Quality Investing Screenchartmill.com

Via Chartmill · February 4, 2026

Intuit Inc. (NASDAQ:INTU) Passes Key Peter Lynch Investment Filterchartmill.com

Via Chartmill · February 4, 2026

INNOVATIVE SOLUTIONS & SUPPORT (NASDAQ:ISSC) Presents a High-Growth Momentum and Technical Breakout Profilechartmill.com

Via Chartmill · February 4, 2026

BMO Capital upgraded Enphase to ‘Market Perform’ from ‘Underperform,’ while hiking the price target to $41 from $31.

Via Stocktwits · February 4, 2026

The quantum computing stock has dropped 18.8% so far in 2026. Buy the dip?

Via The Motley Fool · February 4, 2026

A decline doesn't always mean an automatic buy.

Via The Motley Fool · February 4, 2026

Shares in these two innovative banking entities have soared in the past 36 months.

Via The Motley Fool · February 4, 2026

Lululemon Athletica (NASDAQ:LULU) Passes Peter Lynch's Investment Screenchartmill.com

Via Chartmill · February 4, 2026

The Pound Sterling rises against its peers on expectations that the BoE will hold interest rates steady on Thursday.

Via Talk Markets · February 4, 2026

Can the world's top Ethereum treasury company regain its mojo from last summer?

Via The Motley Fool · February 4, 2026

One of the biggest players in President Donald Trump's Golden Dome missile defense system just went public.

Via The Motley Fool · February 4, 2026

The number depends on a handful of factors, the most important of which is your age.

Via The Motley Fool · February 4, 2026

The initial estimate of the U.S. median household income for December 2025 is $86,820.

Via Talk Markets · February 4, 2026

According to a report by the Financial Times, advisers involved in Tether’s fund raise discussions floated a much smaller raise of around $5 billion.

Via Stocktwits · February 4, 2026

The S&P 500 continues to see the 7,000 level as a major ceiling in the market, as we are waiting to see whether we can get a daily close above that level.

Via Talk Markets · February 4, 2026

In early February, Bitcoin declined to $72,800, reaching its lowest level since November 2024 amid an increase in forced liquidations of leveraged positions and accelerating capital outflows.

Via Talk Markets · February 4, 2026

The stock has averaged annual gains of nearly 14% over the past decade.

Via The Motley Fool · February 4, 2026

Bitcoin just fell to its lowest level in almost a year.

Via The Motley Fool · February 4, 2026

Apple hits a record 69% U.S. market share in Q4 2025! Meanwhile, Motorola becomes the new king of budget phones under $300.

Via Benzinga · February 4, 2026

Aircraft manufacturer Boeing to deliver updated 787 Dreamliner in 1H of 2026 with better fuel economy & cargo capacity.

Via Benzinga · February 4, 2026

Our view for this week remains that data has the most potential to steer USD crosses, and today’s busy US calendar offers a couple of opportunities.

Via Talk Markets · February 4, 2026

Elon Musk's Grok AI continues to generate nonconsensual sexualized images despite X's announced restrictions.

Via Benzinga · February 4, 2026

This will be the year when the neocloud company shows whether its execution can keep pace with its ambitions.

Via The Motley Fool · February 4, 2026

Illinois is joining the WHO's Global Outbreak Alert and Response Network, giving the state independent access to global disease intelligence.

Via Benzinga · February 4, 2026

The current year, 2026, is a so-called midterm election year. For stocks, it is the weakest year in the four-year cycle.

Via Talk Markets · February 4, 2026

Ted Sarandos told US senators that YouTube is now the dominant "TV" platform as he defended Netflix's Warner Bros. Discovery deal.

Via Benzinga · February 4, 2026

Amazon's earnings on Thursday will depend on strong AWS demand, resilient consumer. Bull case relies on sustained AWS growth.

Via Benzinga · February 4, 2026

CEO Brent Ness noted a broad global market, with approximately 266 million people affected by chronic low back pain.

Via Stocktwits · February 4, 2026

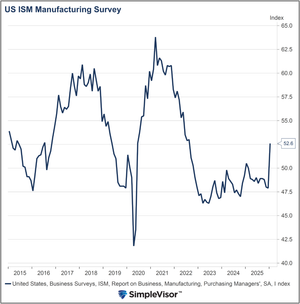

Over the last couple of weeks, we have shared evidence that supports the reflationary narrative and some that defies it.

Via Talk Markets · February 4, 2026

Valuation is one of the key differentiators between these two AI investment options.

Via The Motley Fool · February 4, 2026

Elon Musk wants to make Tesla an early mover in a potential $5 trillion industry.

Via The Motley Fool · February 4, 2026