Berkshire Hathaway (BRK-B)

495.42

-4.99 (-1.00%)

NYSE · Last Trade: Mar 6th, 1:31 PM EST

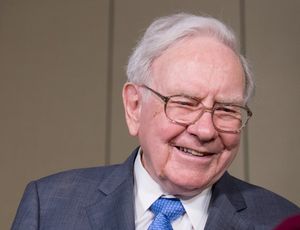

Could one of Warren Buffett's rare losers be a winner for your portfolio?

Via The Motley Fool · March 6, 2026

Investors, drawn by Buffett's investment success over the years, turn to him for inspiration.

Via The Motley Fool · March 6, 2026

The Oracle of Omaha was a persistent net seller of stocks for more than three years leading up to his retirement.

Via The Motley Fool · March 6, 2026

The reported numbers require some important comparative context.

Via The Motley Fool · March 5, 2026

The S&P 500 index faced a harsh reality check on March 5, 2026, as it decisively failed to breach the 6,900 resistance level, tumbling into negative territory for the year. This reversal marks a significant shift in market sentiment, erasing the modest gains of early 2026 and signaling

Via MarketMinute · March 5, 2026

The traditional laws of safe-haven investing were rewritten this week as a sudden escalation in Middle Eastern conflict sent shockwaves through the global economy. In a move that defied decades of market logic, the yield on the benchmark 10-year U.S. Treasury note spiked to 4.132% on March 5,

Via MarketMinute · March 5, 2026

This fintech stock has fallen sharply this year, which makes it an intriguing investment prospect.

Via The Motley Fool · March 5, 2026

Berkshire Hathaway never paid a dividend under Warren Buffett's leadership.

Via The Motley Fool · March 5, 2026

Management made the first major capital allocation decision since Warren Buffett stepped down.

Via The Motley Fool · March 5, 2026

New Berkshire Hathaway CEO Greg Abel could try to distance his investment philosophy from Warren Buffett in the early quarters leading the company.

Via Benzinga · March 5, 2026

As a top Warren Buffett stock for many years, this company remains worthy of consideration.

Via The Motley Fool · March 5, 2026

Berkshire Hathaway resumed its longstanding practice of repurchasing company stock, as Greg Abel replaces Warren Buffett as CEO.

Via Investor's Business Daily · March 5, 2026

Warren Buffett's successor has already started deploying capital to buy back Berkshire stock.

Via Barchart.com · March 5, 2026

Berkshire stated that it can buy its Class A or Class B stock at any time it believes the “repurchase price is below our intrinsic value.”

Via Stocktwits · March 5, 2026

Via Talk Markets · March 5, 2026

A long-term focus and consistency are key to investing success.

Via The Motley Fool · March 4, 2026

Buffett has proven his investing skills over the long term.

Via The Motley Fool · March 4, 2026

Buffett made a big trade in his last quarter as CEO of Berkshire Hathaway.

Via The Motley Fool · March 4, 2026

Berkshire is one of many stocks that could get you to millionaire status.

Via The Motley Fool · March 4, 2026

Berkshire Hathaway's new boss believes these brand-name stocks "will compound over decades."

Via The Motley Fool · March 4, 2026

These stocks should continue to provide value for Berkshire Hathaway and other investors.

Via The Motley Fool · March 4, 2026

These stocks look like long-term winners.

Via The Motley Fool · March 4, 2026

Via MarketBeat · March 3, 2026

Today, March 3, 2026, U.S. stocks slid as oil‑driven inflation fears and Middle East turmoil rattled tech leaders and travel names.

Via The Motley Fool · March 3, 2026

Berkshire Hathaway's GM investment made the conglomerate some money, but it could have been a lot more profitable.

Via The Motley Fool · March 3, 2026